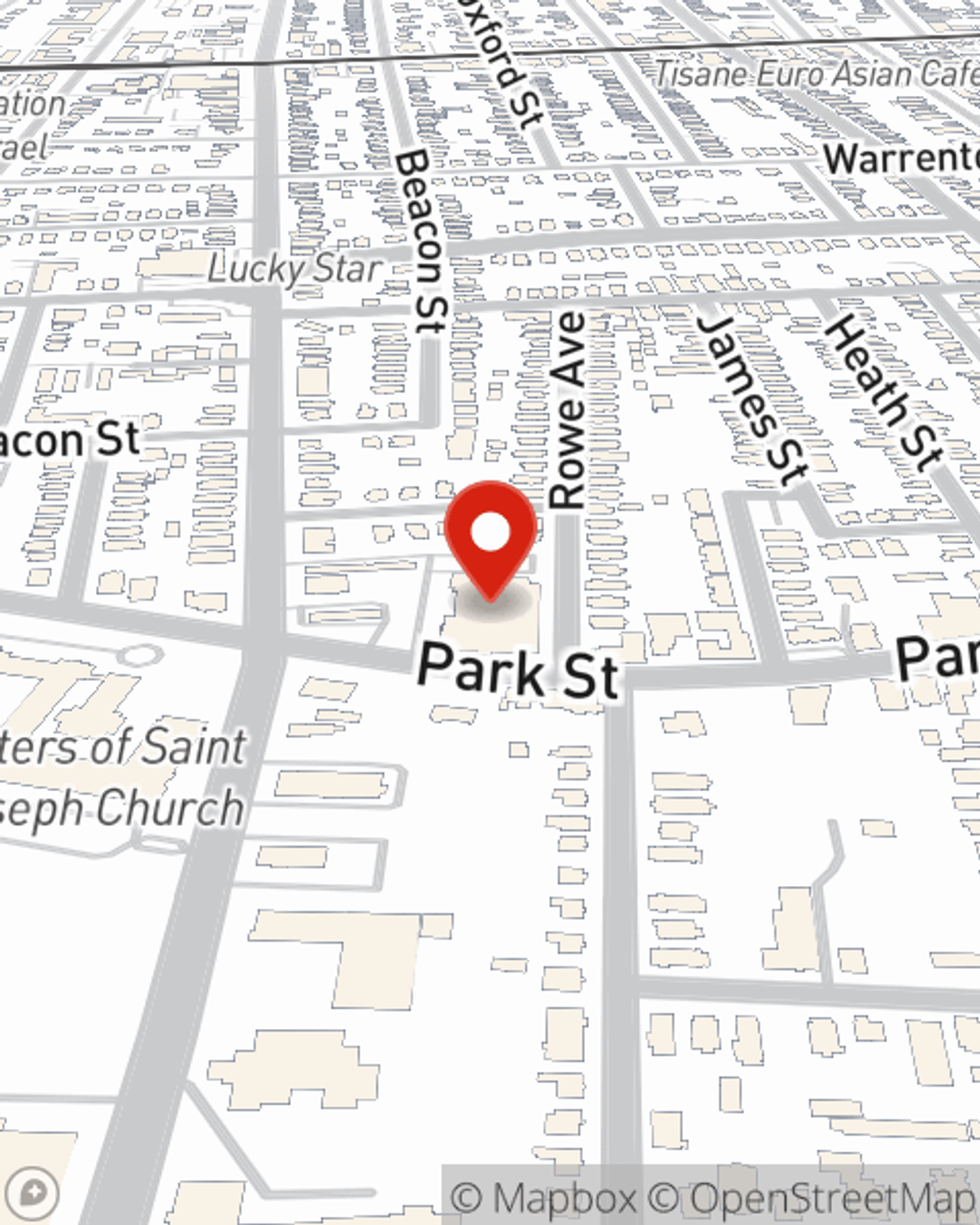

Business Insurance in and around Hartford

One of the top small business insurance companies in Hartford, and beyond.

Cover all the bases for your small business

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, errors and omissions liability and extra liability coverage, you can feel comfortable that your small business is properly protected.

One of the top small business insurance companies in Hartford, and beyond.

Cover all the bases for your small business

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's an arts and crafts store, a home cleaning service, or a book store, having the right insurance for you is important. As a business owner, as well, State Farm agent John Pedraza understands and is happy to offer exceptional service to fit what you need.

Call John Pedraza today, and let's get down to business.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

John Pedraza

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.